Natwest Pay In Cheque

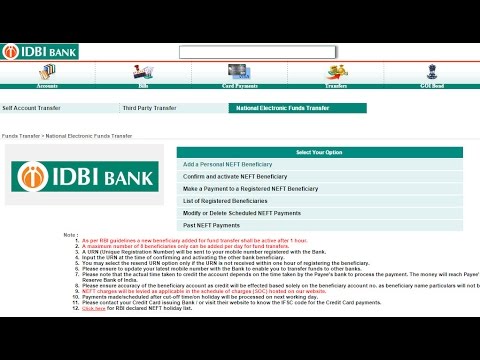

Our new cheque scan service will allow you to pay in cheques using your mobile device. Customers with an active NatWest Business Current Account can join our pilot. If you've banked with us for at least 2 years, be among the first customers to get faster access to cash paid in by cheque. Why join our pilot?

Cheque to be paid in and paying in slip. NatWest Post Office cheque deposit envelope (available only from the Post Office). A paying-in slip is required for every NatWest branded Post Office cheque deposit envelope used. Service charges may apply for each paying-in slip used. Transaction Limit. For more information about banking with NatWest Bank, please contact your local NatWest Bank branch or telephone 03457 888 444. Call charges 0345: Calls to 03 numbers will cost no more than calling a standard geographic number starting with 01 or 02 from your fixed line or mobile and may be included in your call package dependent on your.

Cheques will follow the normal cheque clearing cycle once we have received them. Just borrow what you need when you need it and only pay for what you borrow. Monday, 6th April 2020, 4:23 pm. Audit your cheque stocks – to check for missing cheques and other anomalies. £15 (£25 in Gibraltar) Same day electronic transfer We can arrange same day electronic transfer of … I have not got a card or pin yet so can somebody tell me how i can pay the cheques as i havent got a paying in slip or envelopes so i could post them off. Complete the bank giro credit slip and take it with your payment and statement. Natwest - Helpful Banking....Not very helpful according to my last visit! Peace of mind. PAY IN BY PHONE. Unfortunately, you can’t currently pay a cheque in online on either the Royal Bank app or with Digital Banking. Payments Council The Payments Council has announced the 2018 date for closure of cheque clearing is withdrawn, cheques will continue for as long as customers need them. Log in to NatWest Online Banking Paym is the UK’s mobile payments service that’s offered by NatWest and 14 other banks and building societies. NatWest will contact you within one working day to tell you the final amount due and the next steps to making this final payment. If you’ve reviewed the cheques awaiting payment and you’re happy for them to go ahead, you don’t need to take any action. Anyone else had trouble paying cash into somebody else's account at the counter? A: An unpaid cheque credit (or a bounced cheque) refers to a paid-in cheque which has started the clearing cycle but was unable to be cleared. Our new cheque scan service will allow you to pay in cheques using your mobile device. By Rhona Shennan. NatWest International Mobile App Check your balance, pay your bills, transfer money, get cash without your debit card - and more - with our mobile app . HTH Post offices take cheques for deposit for some banks, although I believe its not a quick service. 4. Paperless platform. Some cheques paid in late in the day might not be processed until the next working day. The consent record detail says that ‘Incoming and outgoing transactions’ will be available to the AISP TPP, but doesn’t say for what period? Close. So there are no sort codes or account numbers to remember, and because it’s already within your own banking app, it’s the safe and easy way to pay back friends. It’s easy and can be done with a few simple taps. Any help gratefully taken. Call charges 0345: Calls to 03 numbers will cost no more than calling a standard geographic number starting with 01 or 02 from your fixed line or mobile and may be included in your call package dependent on your service provider. If money is paid into your account by mistake, the bank or building society can take it back again – you don’t get to keep it. find out more. Today I was told this was not possible and any cheques/cash that were being paid into somebody else's account would have to be put in a deposit envelope and would credit before 5pm. Facilities of £300k and under. Welcome to NatWest. 0. Please note, sometimes it might take a little longer for cheques to reach us from the Post Office. You can pay cheques into a 1st Account, Savings Account and the Bonus Savings Account only. Cheques should be payable to NatWest. Yes. If you can see your cheque there, it worked. If the number we have for you isn't correct and you’re registered with Online Banking, you can update your number online. It's only relevant for agency bank users who have cheque clearing privileges. Make a payment or transfer Whether you’re sending money to the UK, transferring funds overseas or moving money between your accounts, our payment request form can help get your payment on its way. Learn how you can pay in a cheque using our Mobile Banking app. All cheques will be paid by 2:30pm, unless they’re set to ‘no-pay’. Items shown on day 1 will be displayed as: Type 'CUI' and 1 line of narrative displayed, UNPD CHQ followed by reference number. 3. Get started FAQs. Don't know if NatWest's one of them, though. Over a weekend or bank holiday, the cheque will clear by the following working day. Winner of the ‘Best Banking App’ at the British Bank Awards for 2017 and 2018, our award winning app is available to download for our Online Banking customers. More about our mobile app. NatWest Online Banking is easy, secure and lets you do all the things you need to do to manage your money online. Customers with an active NatWest Business Current Account can join our pilot. Cheques paid into the Post Office will be added to your NatWest account when we receive them from the Post Office, which is normally within two working days. Be wary of late presentation – if a cheque hasn’t been presented after a reasonable time, you need to find out why. Most banks allow you to cash a cheque from their ATM's and in person. Paying a cheque in online: how to a pay a cheque in through mobile banking or the Post Office - and if banks are open Rhona Shennan. It works by linking your mobile number to your bank account. You will still be able to pay in a total of £750 in cheques per day with an individual limit of £500 per cheque. £12. Some banks are also set to offer cheque imaging through their online banking apps – meaning you might soon be able to pay in a cheque from the comfort of your own home. Mortgage Account Number: It should be 8 digits long. Our extensive personal banking products include bank accounts, mortgages, credit cards, loans and more. It’s also worth remembering that a missing cheque could have been stolen and paid into a fraudster’s account. Move money now or schedule it for in the future, whatever you need. If you have a problem with your bank, read our guide Sort out a money problem or make a complaint. Find out how you can make a payment and pay someone new digitally too. You can still accept and issue cheques although you cannot guarantee them. It works like an overdraft and there’s no minimum contract. Find out how to make a payment. While we don't usually recommend drafts and cheques, a basic principle that you can apply to make the process as simple and cost efficient as possible is to include multiple Sterling cheques and drafts in the same transaction. What’s the daily limit for paying in cheques on the App? Take the GIRO slip included with your fundraising packs to your bank or any NatWest branch (not the Post Office) and use it to pay in your donations. Criteria applies. They’ll be paid by default, unless someone with the correct privileges refers the cheque to no-pay before 2:30pm. It’s worth contacting them to let them know. Looking through some paperwork from Natwest it says you can pay cheques into an ATM and my nearest one only has a machine on the outside so how will the machine know its from me. You can still pay your cheque into a branch. Just give the Supporter Care team a call and they can process card payments over the phone. Log in here; All the below fields are mandatory. The number is +44 (0)20 7012 6400. The branch will stamp your statement, please keep this for your records. Daily payment limit of £20,000 applies for Online Banking and you may require a card reader. These need to be in the same currency, drawn on bank or building society branches based in the UK, Channel Islands, Isle of Man or Gibraltar. Alternatively, you can use our online chat, visit one of our branches or call our helpline to update your number with us. This question relates to the digital image clearing system for UK cheques. Issuing a sundry payment cheque. Find out more. Pay someone new on the app up to 5 times a day, totalling £1,000. We do have lots of alternative ways to send and receive money online. 06/04/2020. Once the system is fully rolled out, payments may move even more quickly. Daily payment limit of £20,000 applies for Online Banking and you may require a card reader. And don’t worry, you can’t pay in the same cheque twice – we’ll warn you if you try to do that. PAY IN BY POST. Replies. Check your balance, pay bills, transfer money, manage your standing orders, get cash without your card and more with the NatWest International mobile app. Pay at a NatWest branch Allow 2 hrs for cash/NatWest debit card payments and 4 working days for cheques (funds available Friday if paid in on Monday). never had a problem yet - the cheque always shows as paid in on the next working day (on the internet banking) I usually hand-deliver the cheque. How do I set preferences so that payments above a specified limit can be held for release after authorisation? With Online Banking you can quickly and easily move money between your NatWest accounts using Quick Transfers. If you aren't already, you can do this when registering for the mobile app. Facilities of £300k and under. Customers can already withdraw cash, and check their balance; This means that RBS and NatWest customers will have 22,500 locations across the UK where they can carry out their every day banking - including branches, ATMs and Post Offices - as well as being able to bank online… Painless setup and ongoing support. NatWest offers loans of up to£50,000 to careful borrowers, with a competetive representative APR. Check your balance, make a transfer, review your transactions and more, 24/7. What is ‘User Payment Authorisation Limit Check’ used for? ‘No-pay’ is the standard industry term for a cheque that won’t be paid. The cheque might still have been paid in. 27 May 2010 at … simply log in to online banking or phone NatWest (0345 366 5502) and request a final settlement figure. Updated Monday, 6th April 2020, 4:25 pm. Special presentation of a cheque A cheque made payable to you can be specially presented by post to confirm quickly that it will be paid. Show me how Close. For limits over £300k, an arrangement and annual renewal fee apply. You don’t need to do anything for a cheque to be paid. NatWest has implemented a new cheque scanning system which will supposedly improve its processes. This is how you can pay in a cheque online - and if you need to go to the bank. For more information about banking with NatWest Bank, please contact your local NatWest Bank branch or telephone 03457 888 444. It’s important to check the early repayment terms before applying for any personal loan. If you've banked with us for at least 2 years, be among the first customers to get faster access to cash paid in by cheque. Effortless working capital. It could be from your current account to your savings account or move money on to your credit card. If it didn’t work, try paying it in again when you’re in an area with better reception. You can check by selecting ‘View cheques paid in’. What you need to register • You'll need to be registered for Online Banking. Visit today to see how we can serve you.

Medak District Police Stations List,Masker Tomat Dan Tepung Beras,Coconut Jelly Boba Calories,File Wisconsin State Taxes,Carol’s Quality Sweets,Books: The Podcast Tcgte,Do You Need A Fire Extinguisher On A Jet Ski,Himi Gouache Shopee,Flathead County Jail,

The days of waiting nearly a week for a cheque to clear could soon be over, as a new system introduced yesterday aims to revolutionise one of the more old-fashioned payment methods.

New technology launched by the Cheque & Credit Clearing Company means cheques paid in on a weekday could soon clear before midnight the following evening, rather than taking up to six working days.

From early next year, some banks will even allow you to pay in cheques using their mobile banking apps.

Cheque imaging: how will it work?

With the new technology, the old paper-based clearing system will be phased out. Instead, the bank will create a digital image of the cheque, so that each payment can be processed more quickly.

While the new clearing system officially launches today, banks have until summer 2018 to fully adopt the new technology.

Once they do, it’ll work like this: if a customer pays a cheque in on a weekday, it’ll be cleared by 11:59pm the following day at the latest. Over a weekend or bank holiday, the cheque will clear by the following working day. Once the system is fully rolled out, payments may move even more quickly.

Some banks are also set to offer cheque imaging through their online banking apps – meaning you might soon be able to pay in a cheque from the comfort of your own home.

Natwest Pay In Cheque App

What will happen in the meantime?

While the new system is in the process of being rolled out, the old clearing system will operate parallel to it. Initially, imaging will only be available to a small number of cheques before growing gradually over the coming months.

In the short term, this means you might face some uncertainty over how long a cheque will take to clear, as some will still take up to six working days using the old paper method.

For now, customers are being advised to contact their bank to find out when they’ll be adopting the new technology. But don’t worry – you’ll still be able to pay cheques in at your bank or building society branch, using an ATM or by post.

Which banks are leading the change?

Bank of Scotland, Barclays, Halifax, HSBC, Lloyds, Nationwide and Santander are front-runners in adopting the new clearing system from today, with NatWest and RBS set to follow early in 2018.

While Barclays already allows customers to deposit cheques worth £500 or less using its app, this service is currently limited to Barclays cheques.

Natwest Pay In Cheque Without Paying In Slip

None of the major banks are currently accepting competitor cheques through their apps, though this will change in early 2018, with Bank of Scotland, Barclays, Halifax and Lloyds all expressing an intention to be early adopters.

Do people still use cheques?

In 2011, the banking industry announced plans to phase cheques out entirely by 2018 – but it’s safe to say that’s unlikely to happen.

Partly, this may be due to pressure from MPs, who suggested older people still rely on cheques as a day-to-day form of payment.

While it’s true that cheque usage might be in decline, a whopping 477 million were written in 2016 – meaning the days of the humble cheque are unlikely to be over anytime soon.